Hi, I'm Josh

a teacher turned wealth, career and business coach.I am also the owner and founder of V-Affluence, a wealth coaching team that empowers Filipinos make wise financial decision for a brighter future catering more than thousands of clients in the past 5 years.

Years

Working

Experiance

We empower young professionals and parents to understand the psychology of money so they can earn more money, manage their money, grow their money, allocate their money, protect their money and distribute their money.

The main reason why I do what I do because it pains me to see alot of people struggling financially just because of lack of knowledge on how to generate more money, how to handle their finances properly, how to save for their financial goals and how to prepare for future unexpected emergencies.

Growing up, I saw firsthand the impact of financial hardship on families.

My own family struggled to make ends meet at times, and I saw the toll it took on my parents. As a student, I and my siblings were forced to work to help the family.

Studying from 8am to 5pm, working from 5 pm to 10pm and will do the home work at 10pm to 2am.

I have to budget my 500 peso weekly allowance for my daily food expenses, books, computer rent, apartment rent, projects, printing of handouts, lab manuals.

I can only count with my fingertips how many times I rode a jeepney in that 4 years because I always have to save for my next meals

Instead of focusing on my studies, I spent most of my energy thinking what would I eat for my next meal and how can I help paying for my rent?

I code in scratch paper for our computer science courses

I finish my research papers without my own laptop. I wait for my roommates to sleep so I can borrow their laptops to do my projects, research papers and thesis in dawn until sunrise.

That was one of my lowest moments and I almost quit.

It’s difficult. Mahirap maging mahirap

I ate noodles, pancit canton and boiled egg for my meals in those years.

I didn’t join friends whenever they eat out so i can save for my next meal.

Thank God, without His grace I will not finish college.

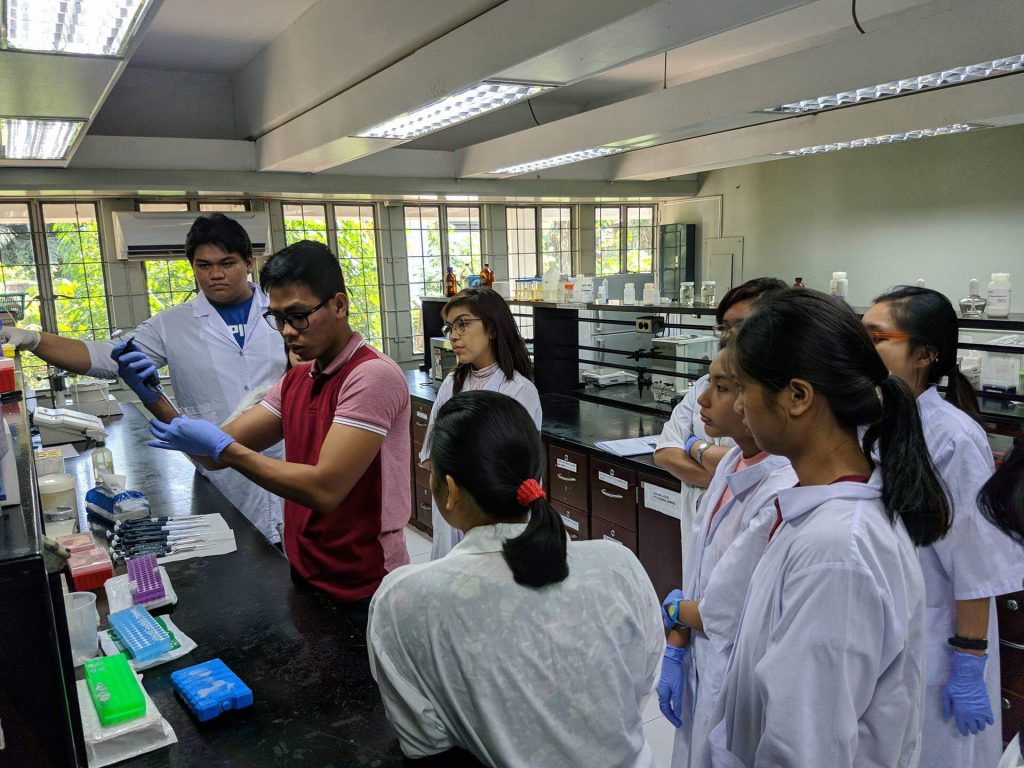

I graduated from University of the Philippines with the degree of BS agricultural biotechnology (cum laude) as one of the top students of our batch and finished my Masters’ degree in Animal Science cognate in Molecular Biology and Biotechnoloy 4 yrs after my undergraduate studies.

As I grew older, I knew that I didn’t want to live my life worrying about money or feeling the constant pressure of financial instability.

That’s why I studied hard thinking that studying hard will give me and my family the life that I we dreamed of.

After graduation, a lot of opportunities became available for me. As a graduate of a prestigious university in the country, I can pursue my masters study abroad, Medical School.

However, I do not have that luxury to choose whatever I want. Because I have to face the reality that I need to work now and provide for my family.

All of that was set aside temporarily just so I can provide for them and send my siblings to school.

Suddenly, I was faced with the reality of managing finances and providing for my loved ones.

I thought everything would be okay after graduating, but I felt like I was struggling even more. Almost half of my income goes to my family, and the other half is spent on our expenses for the month.

This is also the time when I need to pay off the debts that our family has accumulated over time. It’s a sad reality.

I have to try a lot of jobs that I’m not even sure about and that I don’t even like just because I need to earn money.

There are so many responsibilities, so many debts, and delayed payments.

If I continue to work like this and give everything to my family, I might not get married, and I might not even achieve the lifestyle that I dream of for myself and my future family.

After two years of working, I find myself broke.

I realized that the financial system can be overwhelming and confusing, even for those with a degree like myself. Despite my academic knowledge, I still struggled to make the right decisions and create a stable financial future for my family.

There are so many responsibilities, so many debts, and delayed payments.

If I continue to work like this and give everything to my family, I might not get married, and I might not even achieve the lifestyle that I dream of for myself and my future family.

After two years of working, I find myself broke.

I realized that the financial system can be overwhelming and confusing, even for those with a degree like myself. Despite my academic knowledge, I still struggled to make the right decisions and create a stable financial future for my family.

It was during this time that I developed a passion in studying the principles how the money works, how the money grow and how to manage and allocate it properly.

I read books

I’ve watched alot of videos

I asked alot of people

I enrolled alot of courses about finance.

Until I found the answer to my question..

“Bakit ang mga mahihirap hindi yumayaman kahit anong pagtitipid ang gawin? Bakit ang mayayaman hindi naghihirap kahit ang mamahal ng mga binibili nila”

I applied all my learnings. I took action.

And the number 1 rule in personal finance? You must have a positive inflow of cash.

And if I have a negative inflow of cash, I have to create a way to make it positive.

I’ve decided to fInd additional sources of income on top of my full time job.

I juggled being a teacher, Masters student, research assistant and a tutor.

I also used my knowledge in personal finance as I also pursued the career of wealth coaching.

I travelled from Los Banos Laguna to Calamba so I tutor kids from 5pm to 7pm

Then I will travel from Calamba to Metro Manila toI meet my clients from 8pm up until 12 midnight.

Then travel back to Los Banos Laguna so I can rest

And go back to University at 7am.

For 3 yrs just pure hard-work and perseverance sustained by God’s grace and mercy. Work 7 am to 2am everyday with just average of 3 to 5 hrs of sleep for 2 years.

It was a character building season for me.

I struggled alot.

No time for family.

No time for social life.

No time for rest.

Difficult? Yes.

Tired? Yes

Unhealthy? Yes

Sad? Yes

But I do not have any choice.

I do not have the luxury to fail in life.

I do not have that luxury of rest.

I do not have that luxury of quitting.

But I thank God for that season- for the grace He gave me to just continue what I do.

After 3 long years of sacrifice.

I maintained a very positive cashflow allowing me to save money while providing to our family.

Invested some of it for my future. Bought car for our parents. Got married. Bought our own car.

I can now afford to buy things that I used to be just my dream.

I can work anywhere I want.

I can travel to my dream destinations.

I can now afford to rest and sleep for 8 hours.

And I thank God for sustaining me during those years so I can experience the life I am just dreaming of when I was a kid.

Today, lack of financial knowledge seems to still a big problem to many Filipino families leading to more serious relational and mental health problems.

With this realization, I founded my own wealth coaching agency, with a focus on helping people break the cycle of poverty and support the sandwich generation.

I knew that there were many people out there, just like me, who wanted to provide for their families and secure their financial future, but simply didn’t have the resources or knowledge to do so.

I believe that everyone deserves access to the tools and resources they need to create a secure financial future, regardless of their background or financial situation.

Today, I, together with my beautiful wife, and extraordinary team V Affluence are proud to offer personalized and expert financial advice to people from all walks of life.

My commitment to empowering others and breaking the cycle of poverty drives everything I do. Whether you’re just starting out or looking to create a plan for retirement.

I am dedicated to helping you achieve your financial goals and build a brighter future for yourself and your loved ones.

I’m so excited to help you!